ENERGY INDEX: Drilling activity, employment head in different directions

/in News Releases/by Cody BannisterOklahoma Energy Index suggests increased activity in years ahead

/in In the news, News Releases/by Trinity JacksonIndustry employment drives growth in Energy Index

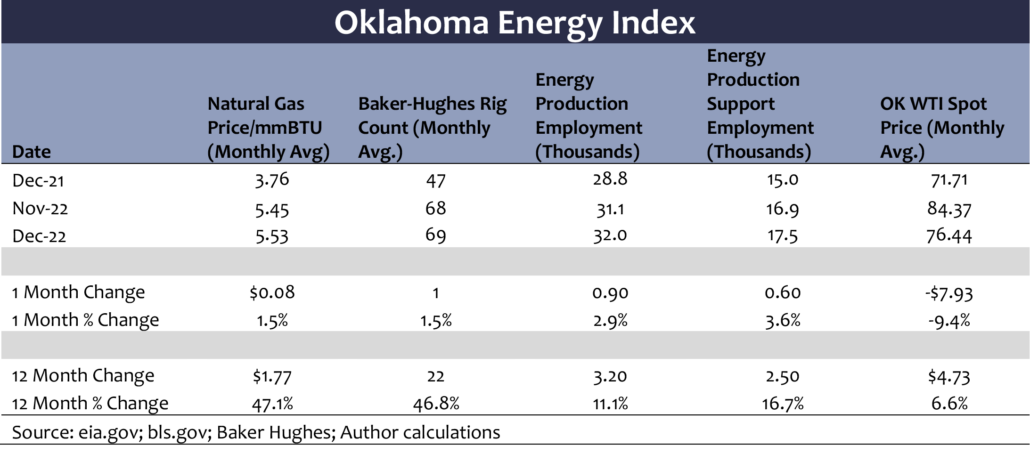

/in In the news, News Releases/by Trinity Jackson The addition of 1,500 jobs in Oklahoma’s oil and natural gas industry helped push the Oklahoma Energy Index higher for the month.

The addition of 1,500 jobs in Oklahoma’s oil and natural gas industry helped push the Oklahoma Energy Index higher for the month.

From petroleum engineers and truck drivers to contractors and manufacturers, the oil and natural gas industry supports a wide range of jobs across the Oklahoma economy. Those new jobs also create employment opportunities outside of the industry, with research from a 2021 PricewaterhouseCoopers study showing that every direct job in the natural gas and oil industry generates an additional 1.9 jobs in Oklahoma.

“The oil and natural gas industry accounted for more than half of the state’s real annual GDP growth over the past decade,” Petroleum Alliance of Oklahoma President Brook A. Simmons said. “A growing oil and natural gas industry grows Oklahoma’s economy. While we are still far from the industry peaks we’ve seen in the recent past, expansion in the oil and natural gas industry benefits Oklahoma workers and the communities they live in.”

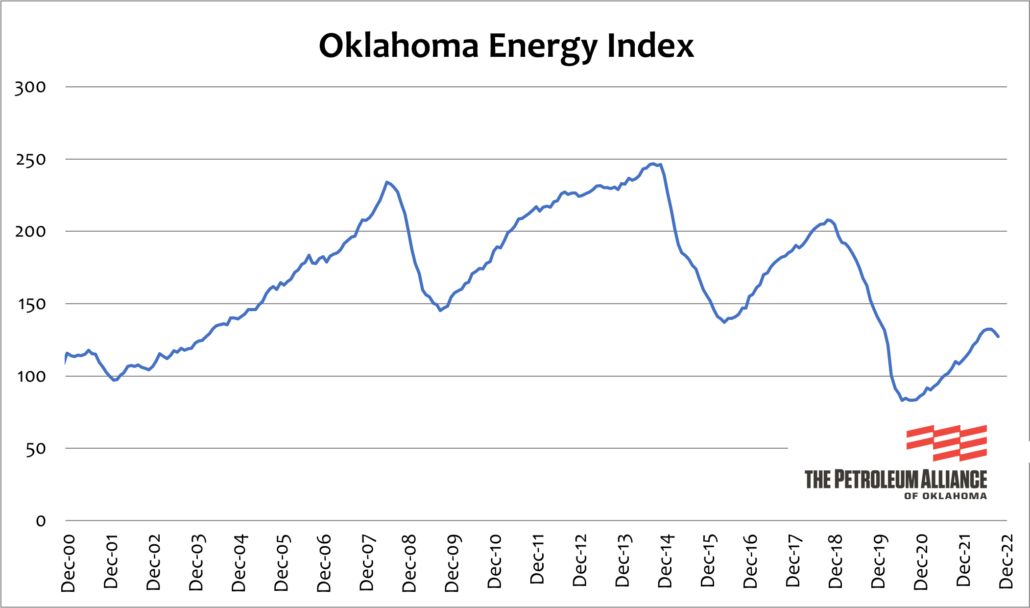

The most recent Oklahoma Energy Index (OEI) increased by 2.8% for the month and now stands at 129.7. The index remains 17.3% higher than year-ago levels.

Dr. Russell Evans, who compiles the OEI, said natural gas prices have dominated energy headlines at the start of 2023 and will likely be the key to the industry’s success in coming months. Oklahoma’s natural gas production increased 7% in 2022, but a warmer than expected winter and lower than expected exports pushed natural gas prices downward, slowing exploration efforts.

Evans said while natural gas prices have moved lower to start 2023, the forward curve anticipates tighter market conditions as the year progresses. It is increasingly unlikely, however, that prices in 2023 rebound to 2022 levels. Instead, expected increases in demand both domestically and for exports will likely be met with modest increases in production with Henry Hub spot prices lower for the year.

“The great unknown for energy markets in 2023 is demand,“ Evans said. “A recession may yet materialize putting downward pressure on demand. But a more optimistic case is slowly developing. Better than anticipated growth in Europe and signals of disinflation in price data give hope to a non-recessionary soft landing. An upside surprise to global growth expectations will demand energy to fuel the expansion, keeping upward pressure on prices.”

The OEI is a comprehensive measure of the state’s oil and natural gas economy established to track industry growth rates and cycles in one of the country’s most active energy-producing states. The OEI is a joint project of The Petroleum Alliance of Oklahoma and Thorberg Collectorate.

ENERGY INDEX: Industry growth stalls, foreshadows coming economic slowdown in Oklahoma

/in News Releases/by Cody Bannister500 NE 4TH Street, Suite 200

Oklahoma City, OK 73104

405.942.2334