Oklahoma ‘all but closed to new drilling’ Energy Index posts largest decline

[av_post_meta av_uid=’av-8xupd’]

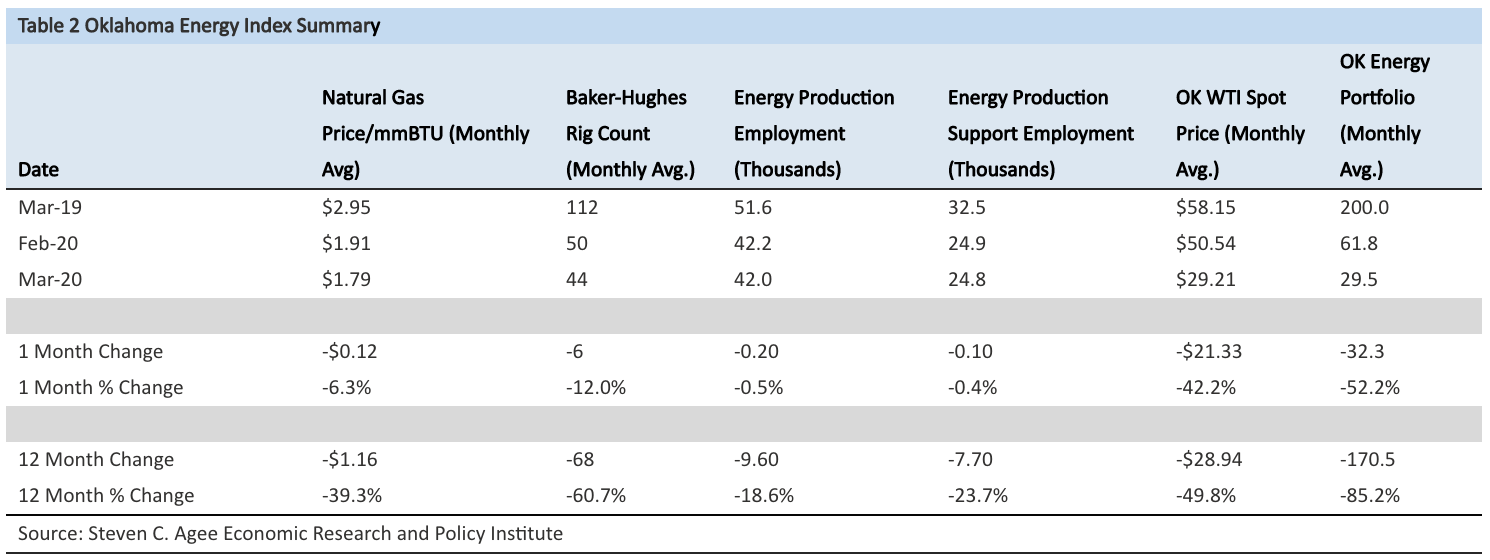

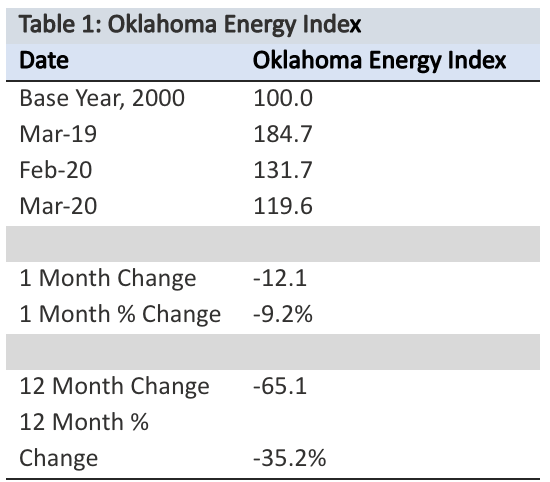

The Oklahoma Energy Index posted its single largest decline in March falling -9.2% as COVID-19 impacts weighed heavily on oil prices and the Oklahoma Energy Portfolio. The contraction exceeded the previous mark set in March 2015 of -7.3%. Industry activity is now down -35.2% from a year ago with more room to fall as oil fields in Oklahoma are all but closed to new drilling.

“All index components were down in March led by a collapse in oil prices as an initial deal by OPEC and Russia failed to materialize and the pandemic response hit energy demand harder than initially expected,” explained Kyle McElvaney, IBC Bank’s Oklahoma City president.

Ultimately, a production cut deal was struck, but even if the deal holds the cuts are unlikely to fully offset the lingering stall in global economic activity. Not yet reflected in the index are the job losses of April or the collapse in drilling activity from 44 active rigs in March to just 15 by early May.

“The coming months will not only prolong this contractionary cycle but also steepen the pace of lost activity,” McElvaney said.

According to Dr. Russell Evans, Executive Director of the Steven C. Agee Economic Research and Policy Institute at Oklahoma City University, it is “only with time will the full economic cost of the COVID-19 health policy be known.”

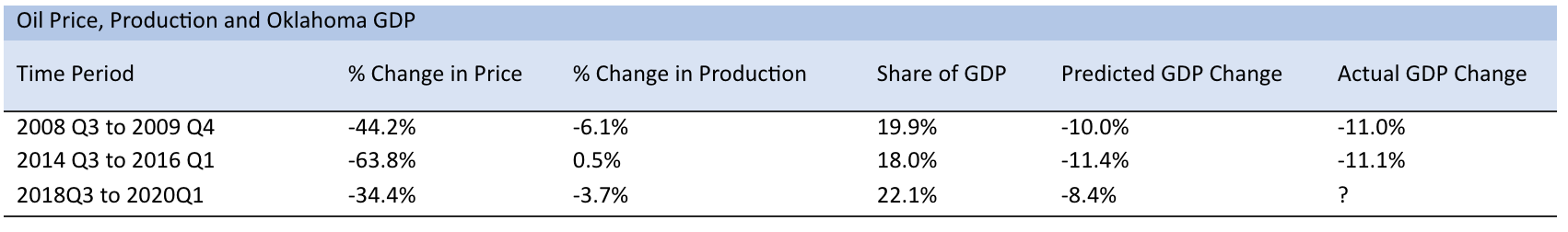

“We can, however, get an early prediction on the energy sector contraction on GDP. As GDP is a measure of the value of production, its component pieces are price and production,” Evans said.

An easy prediction of future GDP impacts from energy market cycles can be found be summing the percent change in oil prices and production and multiplying the result from the sector’s share of GDP. To date, the current energy cycle predicts an 8.4% drop in real GDP. Folding into this prediction the full effects of health policy and related changes in behavior and the state is likely headed towards a recession at least as significant as the previous two.

The full impact to the energy industry may be longer lasting. Models of energy demand had suggested that demand would peak sometime in the next decade. But much of that growth was predicated on continued growth in globalization and air transport fuels not easily replaced by non-fossil fuels. If the current pandemic leaves a long-term scar on globalization that lack of demand growth from this sector could expedite the coming day of peak demand.

“Oklahoma’s energy sector has certainly been through severe cycles before, but this cycle has the potential to be different,” said McElvaney. “While the energy index follows monthly trends, it would be wise to watch simultaneously for long-run shifts Oklahoma’s energy paradigm.”

David D. Le Norman, Chairman of the Petroleum Alliance of Oklahoma pointed to the index’s steep decline as evidence that there is no need for state regulators to force production cuts.

“Free-market forces have driven dramatic cuts in workforce and capital investment in Oklahoma. Currently, we are running only fifteen rigs in our state, down ~ 90% from recent highs. The results are dramatic decreases in our State’s production, all without regulatory influence,” Le Norman said. “Oklahoma’s policy makers must now take care to not further burden the companies and people of Oklahoma’s oil and natural gas business through the adoption of decisions that may have long-lasting, negative consequences. We all should aspire to take a “Do No Harm” stance when it comes to our state’s most important industry.”

The Oklahoma Energy Index is a comprehensive measure of the state’s oil and natural gas production economy established to track industry growth rates and cycles in one of the country’s most active and vibrant energy-producing states. The OEI is a joint project of IBC Bank, the Petroleum Alliance of Oklahoma, and the Steve C. Agee Economic Research and Policy Institute.