OK ENERGY INDEX: WARNINGS OF ECONOMIC DOWNTURN CONTINUE

[av_post_meta av_uid=’av-8xupd’]

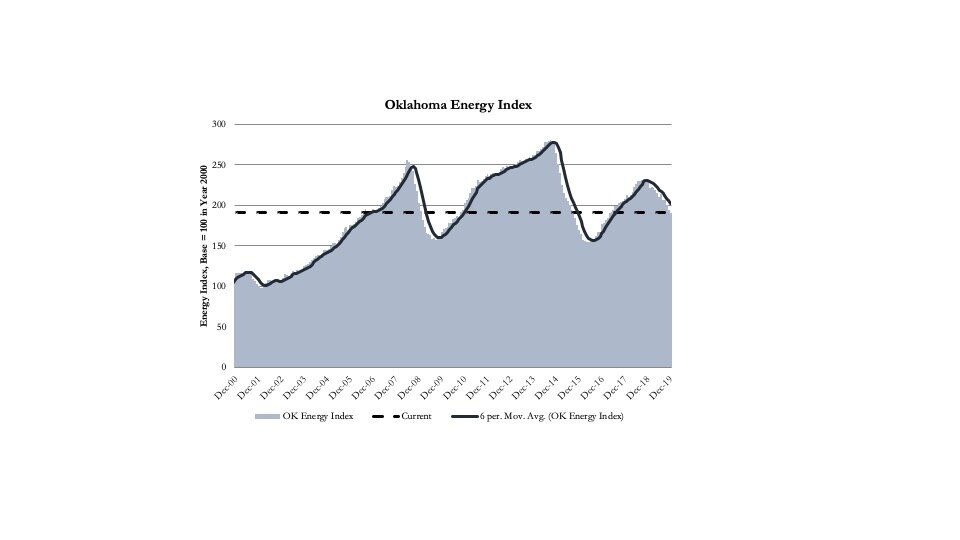

Oklahoma’s energy industry continues to contract with the latest release suggesting a pickup in the pace of job losses in the sector. The Oklahoma Energy Index fell by 1.9% and is now down 16.7% from a year ago. The index was developed as both a coincident indicator of industry activity as well as a leading indicator of future economic activity in the state.

“The index continues to send warning signs of an economic soft patch moving into the state,” said Kyle McElvaney, IBC Bank’s Oklahoma City market manager.

“The move down in December was led by sharp reductions in both primary and support employment and accompanied by a further contraction in the spot price of natural gas,” explained McElvaney.

Rig activity held mostly steady (up 1 rig from November) while spot prices of crude oil and the Oklahoma Energy Portfolio (an equally-weighted basket of stock prices) moved modestly higher. The move up in oil prices will reverse abruptly as coronavirus fears restrict both general economic activity and air travel – a major consumer of petroleum products.

A look at previous periods of industry contraction may help to anchor expectations of future conditions. The energy index last reached its current level in the August 2015. From there, the contraction ran another 11 months before moving into recovery. Prior to the 2015 experience, the index reached current levels in January 2009 and continued to contract for 8 more months before moving into recovery.

“If prior cycles inform current expectations, the industry is unlikely to move into recovery before the fall of 2020, concluded Russell Evans, executive director of the Steven C. Agee Economic Research and Policy Institute. “The current economic weakness that is just now becoming broadly apparent in the state will likewise run through at least the first half of the year.”

The current economic outlook predicts a modest contraction in the state’s economic performance through the third quarter of 2020.

The Oklahoma Energy Index is a comprehensive measure of the state’s oil and natural gas production economy established to track industry growth rates and cycles in one of the country’s most active and vibrant energy-producing states. The OEI is a joint project of IBC Bank, the Petroleum Alliance of Oklahoma, and the Steve C. Agee Economic Research and Policy Institute.

Table 2 Oklahoma Energy Index Summary

| Date | Natural Gas Price / mmBTU (Monthly Avg.) | Baker-Huges Rig Count (Monthly Avg.) | Energy Production Employment (Thousands) | Energy Production Support Employment (Thousands) | OK WTI Spot Price (Monthly Avg.) | OK Energy Portfolio (Monthly Avg.) |

|---|---|---|---|---|---|---|

| Dec-18 Nov-19 Dec-19 | $4.04 $2.65 $2.22 | 141 51 52 | 55.5 50.1 48.6 | 34.8 32.1 31.3 | $49.52 $57.03 $59.88 | 976.8 1,075.9 1,115.7 |

| 1 Month Change 1 Month % Change | -$0.43 -16.2% | 1 2.0% | -1.50 -3.0% | -0.80 -2.5% | $2.85 5.0% | 39.8 3.7% |

| 12 Month Change 12 Month% Change | -$1.82 -45.0% | -89 -63.1% | -6.90 -12.4% | -3.50 -10.1% | $10.36 20.9% | 138.9 14.2% |

SOURCE: Steven C. Agee Economic Research & Policy Institute