OK ENERGY INDEX: STATE HEADED IN TO ‘UNKNOWN ECONOMIC TERRITORY’

[av_post_meta av_uid=’av-8xupd’]

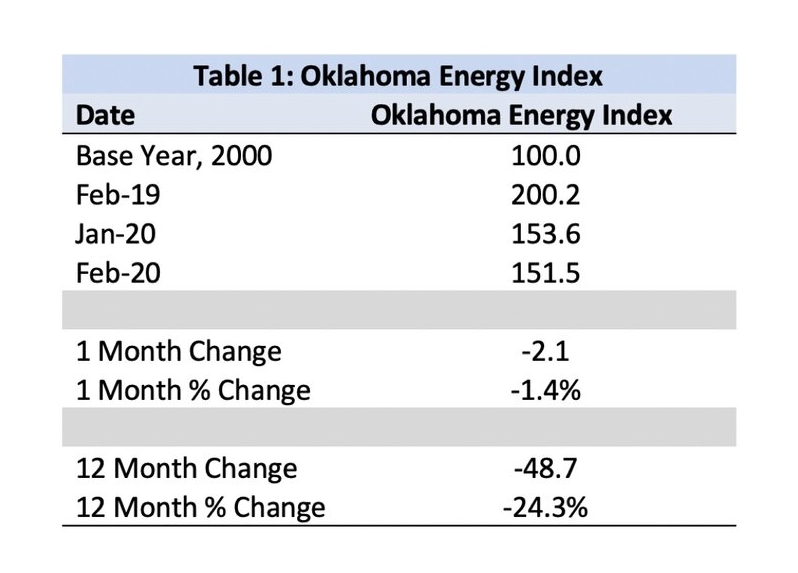

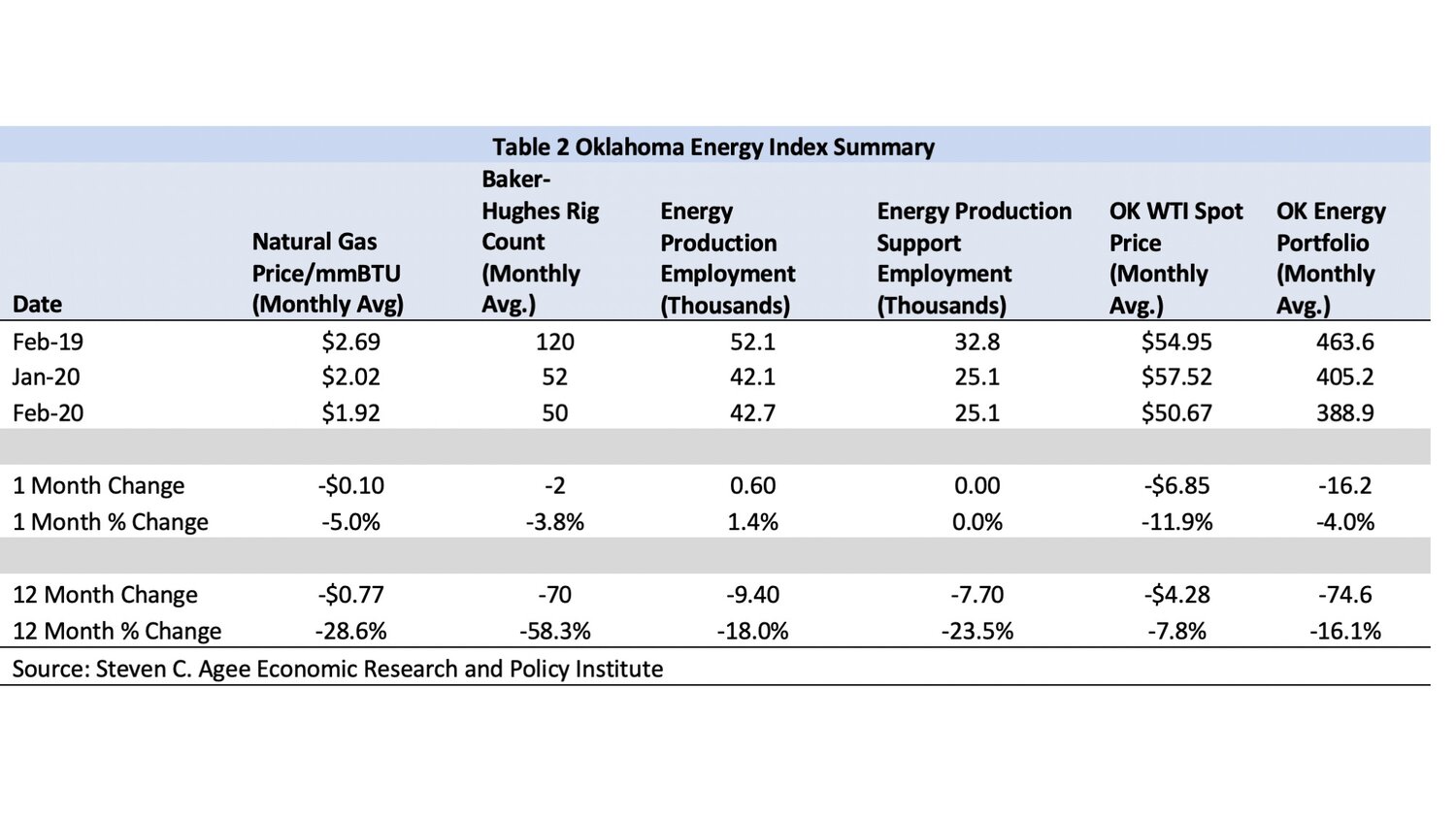

Activity in the state’s oil and natural gas sector continued to contract in February with the Oklahoma Energy Index down 1.4% from January. The February drop marks the sixteenth consecutive month of declining activity. The worst of the COVID-19 related news didn’t hit markets until March suggesting a further and more dramatic drop in activity is yet to come.

All index components were down in February except for primary industry employment. These estimates, however, are subject to revision and are likely to be revised lower with the release of March employment estimates. Importantly, the data through February do not yet reflect the outright collapse in oil prices that will begin to be seen in the March index release.

“It is important to remember that Oklahoma was already heading into a mild oil cycle recession before COVID-19 related restrictions,” explained Dr. Russell Evans, Executive Director of the Steven C. Agee Economic Research and Policy Institute at Oklahoma City University.

“These restrictions will constrain the flow of goods and services through the economy and create one of the most abrupt and severe recessions ever experienced in a developed economy.”

According to said Kyle McElvaney, IBC Bank’s Oklahoma City market president, the recession will “obscure the Oklahoma reality” that our economic weakness is part policy (the COVID-19 restrictions) and part structural (the oil contraction). McElvaney predicts that a “tremendous amount” of monetary and fiscal stimulus will hit the economy this spring and summer and will linger in the system through 2021.

“It is most likely that Oklahoma will experience a short but abrupt disruption before enjoying a stimulus-fueled recovery. But this recovery will likely too obscure the reality that structural weakness remains in the oil and natural gas sector. It is difficult to see a path back to prices sufficient to support robust drilling and production in the state anytime soon. Further, the collapse in prices will disrupt cash flow and already existing strategies to strengthen challenged balance sheets,” said McElvaney.

Russell agreed, saying, “Oklahoma, like most states, is headed into unknown economic territory. The economic floor is dropping out from underneath us, but the promise of stimulus efforts gives reason to hope for an abrupt recovery. Through it all, however, the state’s energy industry will struggle as it continues to transition to what may be a new global oil reality.”