OK ENERGY INDEX SPELLS TROUBLE FOR STATE

[av_post_meta av_uid=’av-8xupd’]

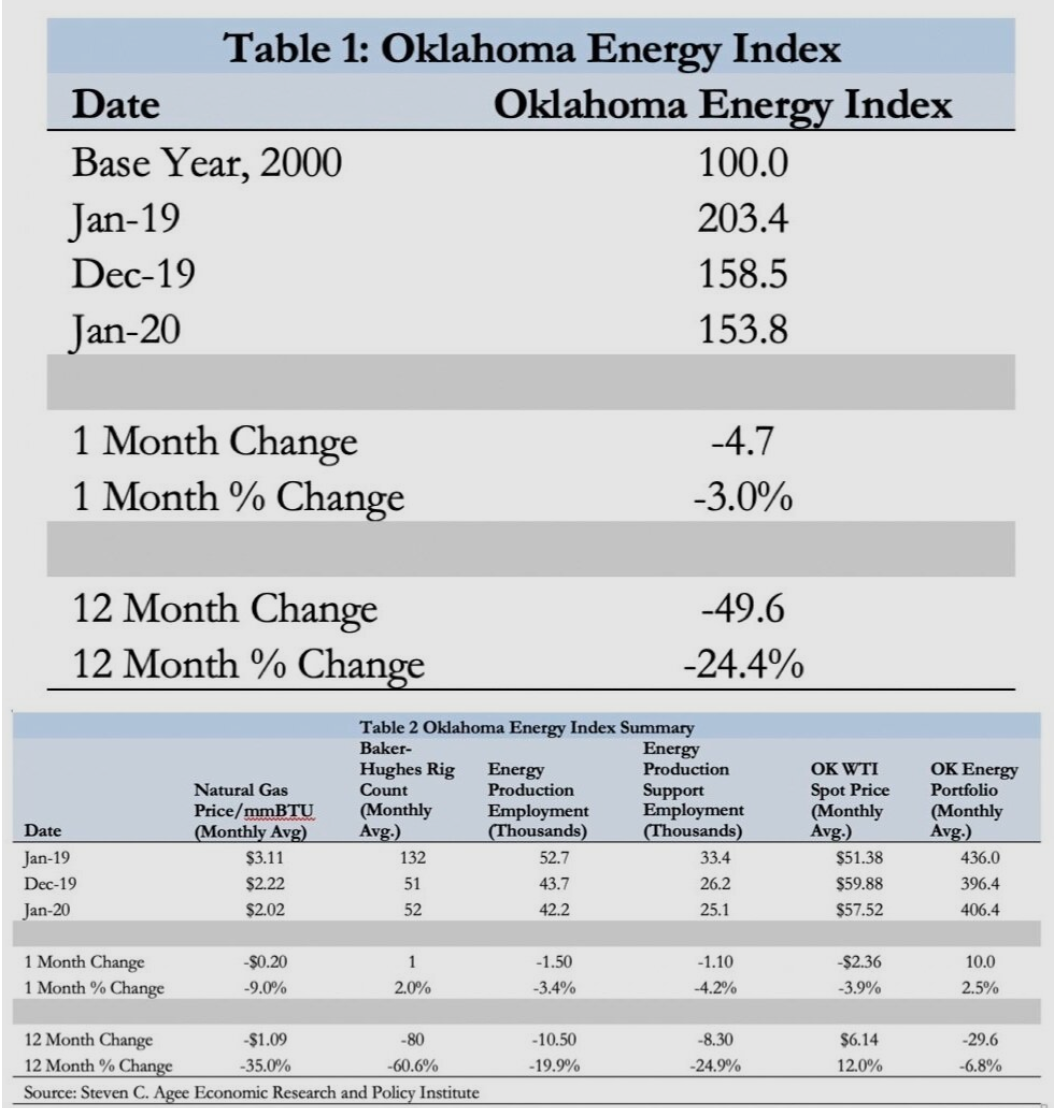

The release of January employment data coincided with an unprecedented collapse in the stock market, a new age of social distancing amid the coronavirus pandemic, and a Saudi oil production strategy testing how low oil prices can go. The January data reveal, not surprisingly, that oil and natural gas job losses in Oklahoma were greater than originally estimated in 2019. The revisions to the employment combined with prices of oil and natural gas that were already falling in January pulled industry activity down 3.0% from the month previous and down 24.4% from a year ago.

Natural gas prices were down 9% from December to a January average price of $2.02 while oil was down 3.9% to an average January price of $57.52. To put this in perspective, current natural gas prices (as of late March) are closer to $1.60 with oil prices at $22.30.

“It is difficult to exaggerate the stress the current economic and commodity market climate will put on Oklahoma companies,” said Kyle McElvaney, IBC Bank’s Oklahoma City market president.

Oil and natural gas employment continues to shrink as a share of total employment in the state. At the most recent 2014 peak, oil and gas payrolls accounted for nearly 65,000 jobs in the state. During the rebound in activity in 2017 and 2018 employment climbed back to 54,000 jobs.

Employment has since fallen to just over 42,000 jobs and capital markets continue to signal a dislike for the energy sector generally and Oklahoma geology specifically.

“If the state does recover to 2018 employment levels it won’t be for many years and the state may never return to 2014 industry employment levels. We may be in a period of market-driven diversification to a new state economic identity,” McElvaney said.

Dr. Russell Evans, Executive Director of the Steven C. Agee Economic Research and Policy Institute at Oklahoma City University agreed, saying “ Coronavirus induced economic weakness was already putting downward pressure on oil prices when Saudi Arabia, unable to negotiate further production cuts with Russia, increased production dropping the floor out from under prices.”

“Current restrictions on economic activity in the U.S. in response to the pandemic will self-impose one of the most dramatic and immediate recessions on record. Best case scenarios have the U.S. beginning to return to normal economic activity in the third quarter of the year. The stress to oil and natural gas companies, however, will linger much longer,” said Evans.

The Oklahoma Energy Index is a comprehensive measure of the state’s oil and natural gas production economy established to track industry growth rates and cycles in one of the country’s most active and vibrant energy-producing states. The OEI is a joint project of IBC Bank, the Petroleum Alliance of Oklahoma, and the Steve C. Agee Economic Research and Policy Institute.