Economist: OK Energy Industry ‘Must Confront Reality’

[av_post_meta av_uid=’av-8xupd’]

July Energy Index shows state’s largest industry still

fighting to recover

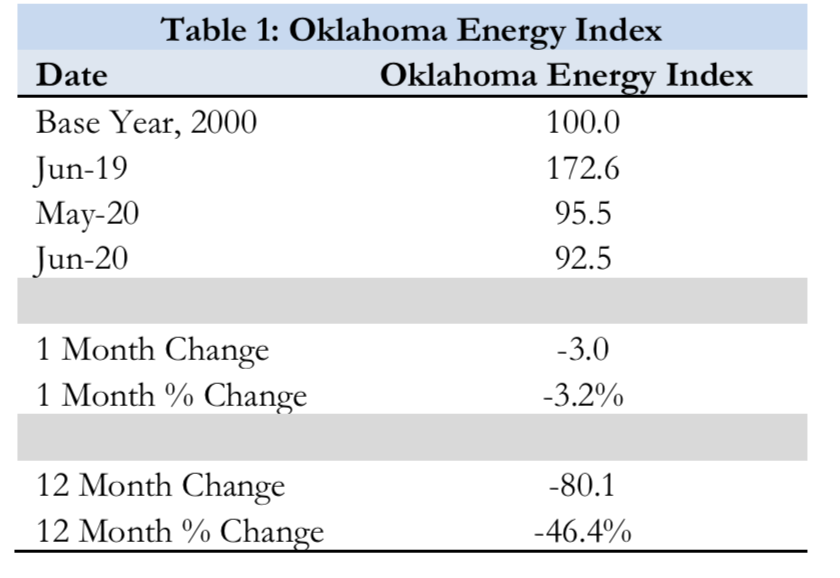

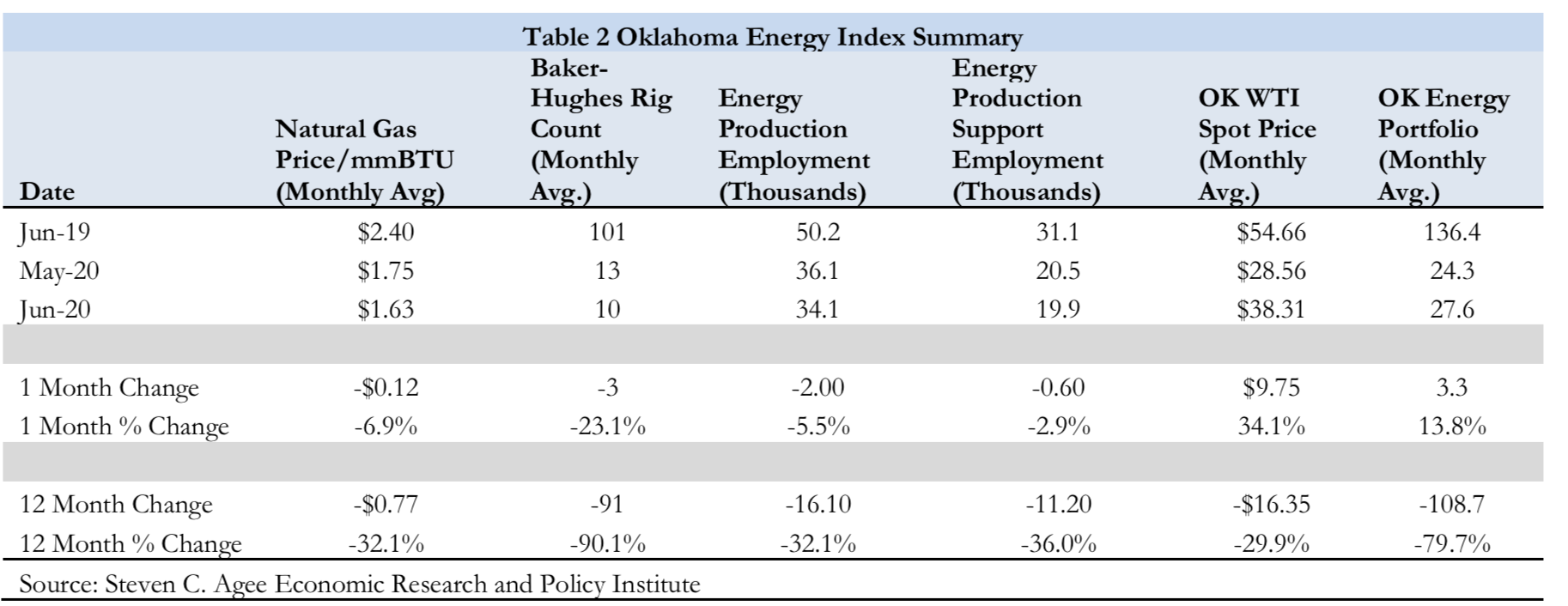

The Oklahoma Energy Index contracted again last month as employment and rig activity continue to fall. Payroll employment of exploration and production companies fell to just over 34,000 jobs, a level of employment last seen in 2005. At the same time, Oklahoma averaged only 10 active rigs in any given week as new drilling has all but stopped in the state.

“To put this in context, the last two bust cycles saw a 2009 low in rig activity of 75 and a 2016 low of 57 rigs,” said Dr. Russell Evans, Executive Director of the Steven C. Agee Economic Research and Policy Institute at Oklahoma City University. “The abrupt stop in activity is without precedent in recent price cycles.”

“We remained concerned that markets are expecting too much from the nascent economic recovery. There seems to be a broad and false sense of security that, having moved from a largely closed, shelter-in-place economy to more open economic activity that the worst is behind us. This is not the case,” asserted Evans. “The effects of the pandemic coupled with the economic repercussions of early and aggressive health policy will move the U.S. economy into a lengthy recession.”

The Petroleum Alliance of Oklahoma President Brook A. Simmons said, “We’ve not been Pollyannish about the challenges our industry faces. While we have recently seen product demand increases and perhaps the floor with regard to rig activity, we’ve known reality was not indicative of a v-shaped recovery. Oklahoma still must confront the reality of the looming economic recession. When global markets do find balance, the first barrels of production added back to the market are likely to come first from abroad and then from the U.S. Permian Basin. It may take a significant increase in net demand for crude products to move prices back to a range that supports robust Oklahoma oilfield activity.”

Table 2 (below) summarizes the depths of the current oil bust. Both oil and natural gas spot prices as well as both production and support employment are down at least 30% from a year ago.

“During the recovery from the 2015-2016 bust we noted that production employment would not return to the 2014 high of 65,000 jobs,” said Crystal Laux, south regional manager with BITCO. “Indeed, production employment managed to move back to 54,000 jobs in 2018 before moving back into a contractionary phase of the cycle.

“Production employment now stands at 34,000 jobs and seems unlikely to return even to 2018 levels. In the years ahead we may find that each ensuing recovery, while welcomed for the economic relief that it brings, is insufficient to fully replace the activity lost in the preceding bust,” concluded Laux.

The Oklahoma Energy Index is a comprehensive measure of the state’s oil and natural gas production economy established to track industry growth rates and cycles in one of the country’s most active and vibrant energy-producing states. The current index is a joint project of BITCO, The Petroleum Alliance of Oklahoma, and the Steve C. Agee Economic Research and Policy Institute.