Oklahoma Energy Index points to prolonged economic uncertainty

[av_post_meta av_uid=’av-8xupd’]

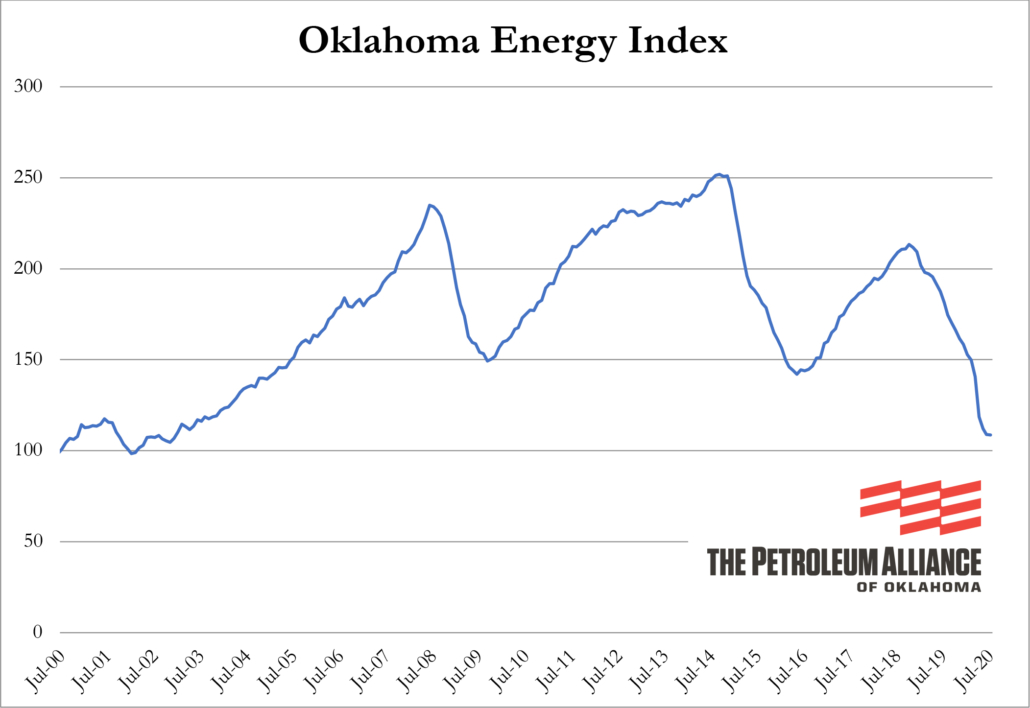

The downturn in Oklahoma’s oil and natural gas industry may be reaching its lowest point, but the Oklahoma Energy Index (OEI) raises concerns for prolonged economic uncertainty for the state and its defining industry.

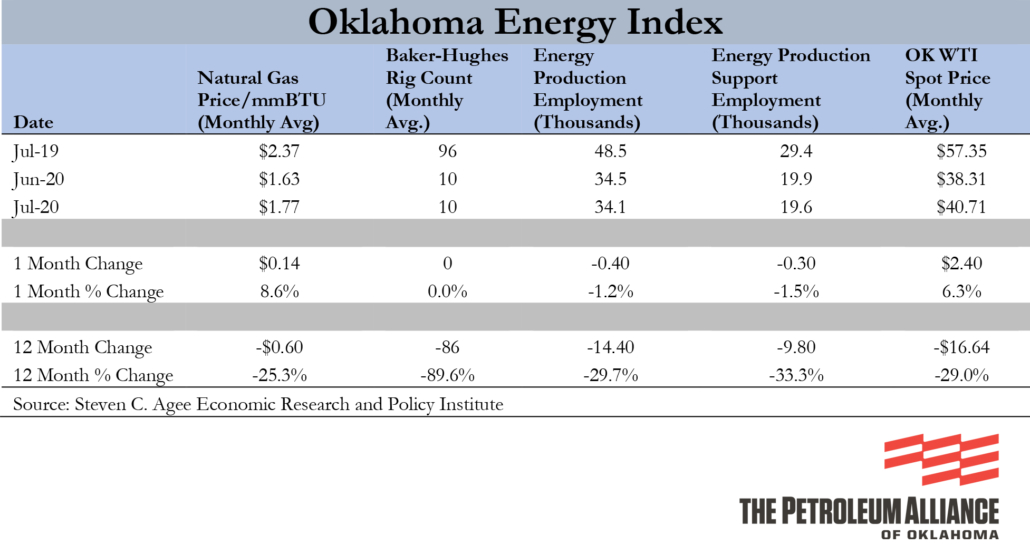

With the state’s rig count holding steady, decreases in production and support employment at less than 2% and slight increases in both crude oil and natural gas prices, the contraction of the OEI and the industry as a whole has slowed. The most recent Energy Index stands at 108.8, down just 0.1% from the month prior but 42% less than one year ago.

Dr. Russell Evans said the index has contracted for 22 consecutive months, the longest negative streak in the 20 years covered by the index. Evans noted that activity levels in the state’s oil and natural gas industry are trending towards a level not seen since the launch of the U.S. shale boom in the early 2000s.

“With nearly unprecedented uncertainty of future economic conditions and energy demand, the energy industry’s critical contributions to the state’s economy may be quiet for some time.” – Dr. Russell Evans

“While I expect we haven’t heard the last of consolidations, debt restructurings, asset sales and layoffs, there is evidence that the current cycle is searching for a bottom,” said Evans, executive director of the Steven C. Agee Economic Research and Policy Institute. “But with nearly unprecedented uncertainty of future economic conditions and energy demand, the energy industry’s critical contributions to the state’s economy may be quiet for some time.”

Comparing pre-shale Oklahoma activity from 2000 with today’s levels shows a dramatic decrease in drilling activity. Two decades ago, there were 91 drilling rigs running in Oklahoma. In July, the data used to calculate this month’s Energy Index, there were only 10.

Petroleum Alliance President Brook A. Simmons said the rapid decrease in drilling activity over the past 12 months is a primary driver in the decrease in oil and natural gas industry employment, but warned that more job losses are imminent as exploration and production companies reduce headcounts to match decreased exploration budgets.

“We hope we have reached the bottom of this devastating downturn regarding drilling activity,” Simmons said. “Even if we are at the bottom, there is prolonged economic uncertainty ahead of us. Drilling rigs are the best barometer for Oklahoma’s economy as well as the state budget. With a decreased level of drilling activity for the foreseeable future, state policymakers must prepare now for a weakened oil and natural gas industry that is unable to deliver funding levels of the past.”

For business leaders in Oklahoma’s oil and natural gas industry, the ebbs and flows of supply and demand mean a continual re-evaluation of forecasts and future plans. The economic position they are in now, however, goes far beyond that.

“All businesses who are even remotely tied to the oil and natural gas industry are suffering,” said Ethan House, vice president of business development for energy industry acquisitions and divestitures firm EnergyNet. “Oklahomans are resilient. The oil and gas industry is resilient. There will be a recovery, but that may be years away.”

The OEI is a comprehensive measure of the state’s oil and natural gas economy established to track industry growth rates and cycles in one of the country’s most active energy-producing states. This month’s OEI is a joint project of The Petroleum Alliance of Oklahoma, the Steven C. Agee Economic Research and Policy Institute and EnergyNet.