Little Economic Relief for Oklahoma’s Largest Industry in June

[av_post_meta av_uid=’av-8xupd’]

Oklahoma Energy Index shows recovery still over the horizon

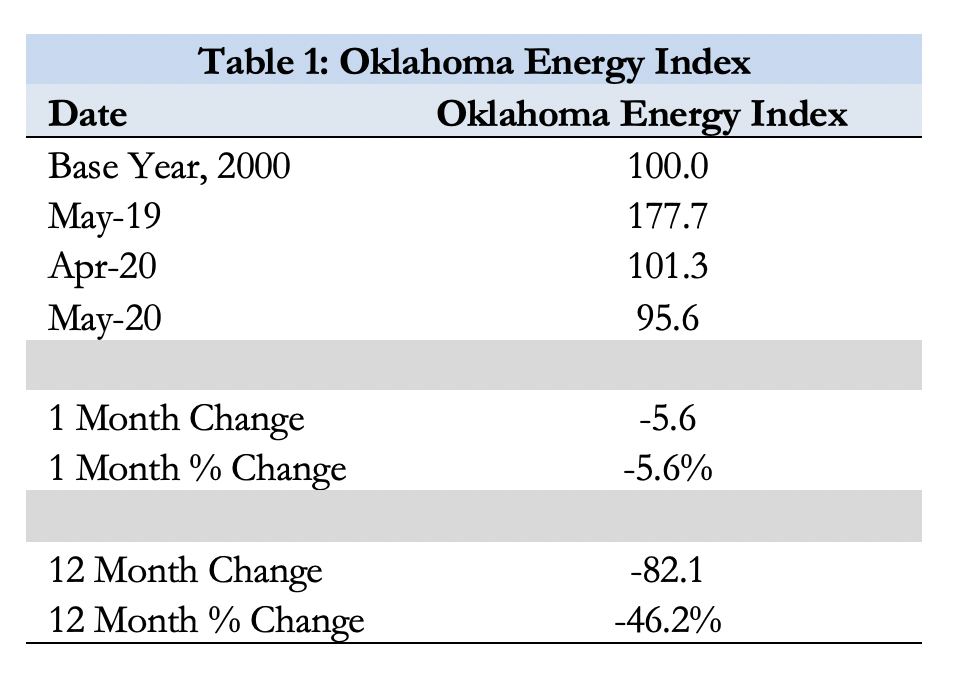

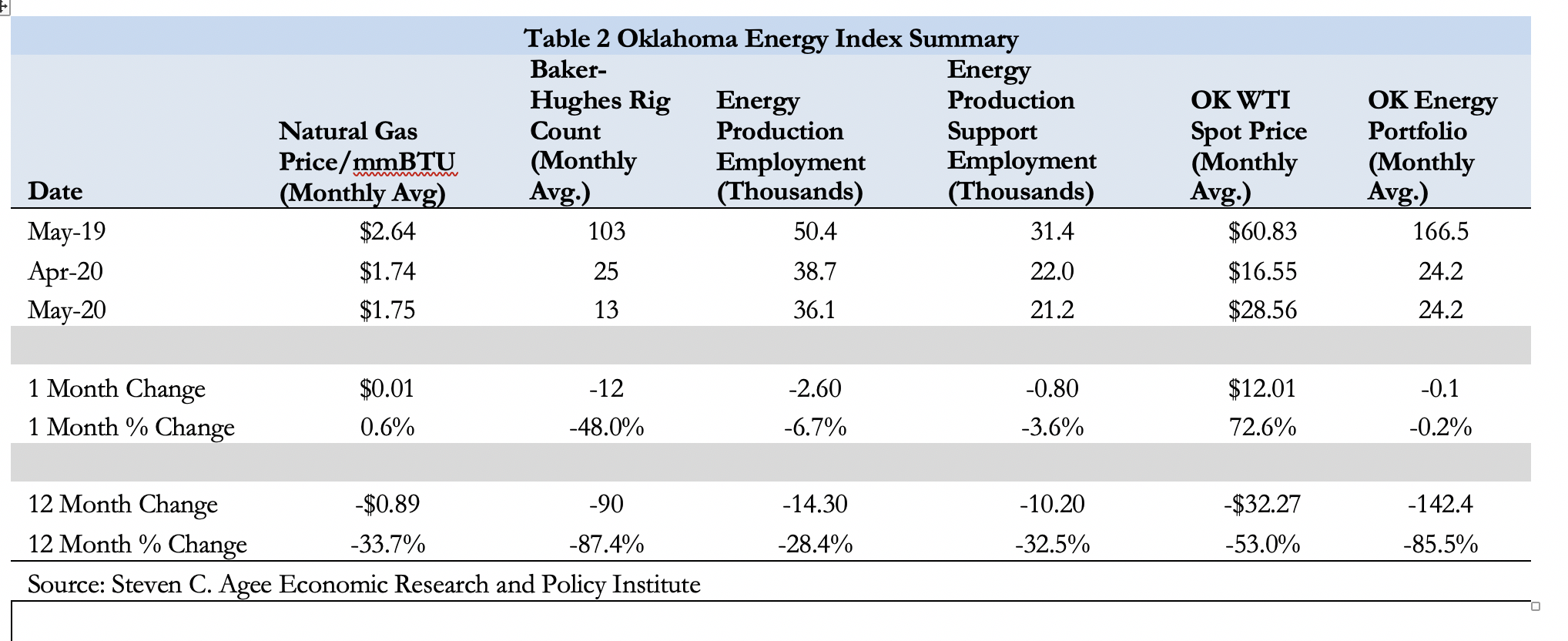

The Oklahoma Energy Index contracted sharply again in June as employment and rig activity fell to levels rarely seen in the 20-year window of the index. What started nearly two years ago as a mild industry contraction matured into a bust of historic significance when paired with a global pandemic.

The most recent great oil boom concluded in the fall of 2014 before yielding to 20 months of contraction with the energy index falling an average of 3.1% per month. The ensuing recovery was less than robust, recovering only a portion of the jobs and income lost in the downturn. The recovery turned to contraction as 2018 turned to 2019 and is now 21 months long, with an average monthly index contraction of 3.4%.

“Unfortunately, it is increasingly difficult to see a quick path to a bottom and even more difficult to see a robust recovery in the near future,” said Dr. Russell Evans, Executive Director of the Steven C. Agee Economic Research and Policy Institute at Oklahoma City University.

The index of oil industry activity was down 5.6% in May led by sharp falls in employment and rig activity.

“The industry is shedding jobs with new activity on hold,” said The Petroleum Alliance of Oklahoma president Brook A. Simmons. “It could be months until operators can identify an economic and price path forward in which they can have confidence. In the meantime, activity likely will stay muted while companies cut jobs, assets, and costs to better align with limited cash flow.”

The early response to the coronavirus pandemic was to close economic and social activity with safer-at-home and shelter-in-place orders. Crystal Laux, south regional manager with BITCO, said that one consequence of the policy was to immediately impose a broad-based recession on the U.S. economy.

“As states have moved to re-open, the hope is that any recession will go away as quickly as it appeared,” Laux said. “Those who hope for a quick return to economic normalcy, however, may be disappointed. Even without the current widespread increase in positive cases, the economic damage already incurred would take years to fully undo.

“The unfortunate reality for Oklahoma’s oil and natural gas industry is that the U.S. recession is just beginning. It will be months, at least, before the economy is firmly on the path to economic recovery and pulling with it demand for energy sufficient to provide prices that will support Oklahoma activity once again,” concluded Laux.

The Oklahoma Energy Index is a comprehensive measure of the state’s oil and natural gas production economy established to track industry growth rates and cycles in one of the country’s most active and vibrant energy-producing states. The current index is a joint project of BITCO, The Petroleum Alliance of Oklahoma, and the Steve C. Agee Economic Research and Policy Institute.